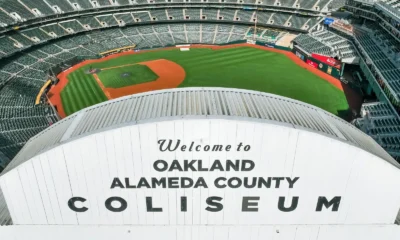

Oakland County

Early results show Oakland sales tax measure passing

Residents of Oakland appear to have agreed to extend the gross sales tax charge from 10.25% to 10.75% to assist pay for core providers.

Fourty -four p.c of voters accredited Meet AIn response to an early rotation printed by the Alameda County Registrar or Voters on Tuesday night.

The outcomes can change the next week as a result of extra votes are counted.

The turnover tax improve is predicted to generate as much as $ 30 million in additional earnings for town and can expire after a decade. The cash goes to the final fund, that metropolis officers have probably the most discretion about how they will spend. Nevertheless, this fund is especially used to pay for police and fireplace brigade.

The Oakland metropolis council agreed in January to set the gross sales tax proposal to the particular election temper after monetary workers had warned that Oakland wants new sources of earnings to deal with its structural scarcity. In latest months, Oakland has lower the police academies, quickly closed fireplace barracks, lower subsidies for varied providers and metropolis staff dismissed to resolve a scarcity within the present price range. The town is making ready for a nonetheless grimmer monetary state of affairs within the subsequent price range, which begins on July 1.

The gross sales tax had an uniting impact within the political space. Barbara Lee and Loren Taylor, probably the most distinguished candidates within the mayor’s race, supported each. The identical applies to Charlene Wang and Kara Murray-Badal, the candidates within the District 2 race which have collected probably the most cash and notes.

The Oakland commerce unions donated cash for measures and spent round $ 264,000. They promoted the tax improve as a strategy to preserve Oakland protected, the place mailers promised that it could enhance 911 response occasions.

Oakland voters will not be shy to vote to burden themselves. In November, residents voted by means of broad margins to approve two new taxes to pay for nature fireplace prevention providers and police, fireplace brigade and prevention.

Nevertheless, there was much less enthusiasm for gross sales tax. A survey carried out earlier this 12 months by the Finances Advisory Fee confirmed that 44% of the respondents opposed the tax, whereas solely 31% supported it.

Meet A solely wants a easy majority to succeed, and in contrast to the opposite two objects on the temper, will not be topic to ranked alternative.

The editorial boards of the East Bay Times and the San Francisco Chronicle Reverse the gross sales tax, with the argument that Oaklanders are already paying a better charge than many cities within the Bay Space and California, and that the leaders of town should take different measures to steadiness the price range.

A gaggle known as “Cease the turnover tax, no on a” for voters to reject measure A, and in no less than one case Posted a bannerHowever opposition was in any other case restricted.

Oakland is voting for the brand new charge with six different cities from Alameda County: Alameda, Albany, Hayward, Newark, San Leandro and Union Metropolis. Spur, a non -profit group that focuses on good governance, has reported Oakland’s turnover has fallen since 2019. Oakland additionally has a decrease turnover tax per head of the inhabitants than different cities as a result of it lacks “giant field” shops, which stimulate loads of promoting in adjoining areas. The rise of on-line retailers similar to Amazon may chip from native bodily sale.

-

Michigan1 month ago

Michigan1 month agoUS District Judge rules that President Trump can dismantle USAID

-

National News4 weeks ago

National News4 weeks agoWATCH LIVE: Stranded NASA astronauts heading back to Earth in SpaceX capsule

-

Michigan1 month ago

Michigan1 month agoPresident Trump’s Address to Congress – Key Takeaway

-

National News3 weeks ago

National News3 weeks agoHomeland Security Sec Kristi Noem visits notorious El Salvador prison

-

Michigan3 weeks ago

Michigan3 weeks agoTrump’s new 25% auto tariff policy: Read what it says

-

Oakland County1 month ago

Oakland County1 month agoLegendary Oakland artist D’Wayne Wiggins of Tony! Toni! Toné! dies at 64

-

Michigan2 months ago

Michigan2 months agoMichigan forest worker hoped Trump’s victory would change her life, but not like this

-

Oakland County2 months ago

Oakland County2 months agoOakland has been paying too much overtime to city workers, watchdog reports