National News

White House quietly mulls millionaire tax hike as House GOP leaders object

White Home assistants quietly drive a proposal inside the GOP of the home that will improve the tax price for individuals who earn greater than $ 1 million to 40%, two sources which are acquainted with discussions informed Fox Information Digital to compensate the prices for eliminating suggestions for additional time, tipped wages and the social safety of retired individuals.

The sources emphasised that the discussions have been solely in the interim, and the plan is that one among many is spoken about as congress republicans engaged on selling the agenda of President Donald Trump via the price range coordination course of.

Trump and his White Home haven’t but taken a place on this, however the concept is seen by his assistants and employees on Capitol Hill.

Within the meantime, Gop leaders of the home, together with speaker Mike Johnson, R-La., Have public towards the thought of tax will increase.

Trump open to ship violent American criminals to the prisons of El Salvador

Speaker Mike Johnson is engaged on President Trump’s agenda via the price range coordination course of (Getty Pictures)

“I’m not an enormous fan of doing that. I imply, we’re the Republican celebration and we’re for tax discount for everybody,” Johnson stated on “Sunday Morning Futures.”

A Gop legislator requested concerning the proposal and granted anonymity to talk frankly, stated they might be open to help it, however most popular the next place to begin than $ 1 million.

They stated the response was “blended”, amongst different issues, home republicans. However not all Huis van de Huis GOP legal guidelines are conscious of the discussions, and it’s not instantly clear how broad the proposal is distributed.

However, it signifies that Republicans are deeply distributed about how they’ll carry out Trump’s tax agenda.

Meet the Trump-picked legislators who give the speaker Johnson a full home Gop convention

Enlargement of Trump’s 2017 Tax Cuts and Jobs Act (TCJA) and the execution of its newer tax proposals is a cornerstone of the plans of the Republicans for the price range coordination course of.

By decreasing the brink of the Senate for the passage of 60 votes to 51, it allows the celebration to energy to save lots of opposition to tackle a radical piece of laws that promotes its personal priorities – offered that the measures cope with tax, expenditure or the nationwide debt.

It’s anticipated that increasing Trump’s tax cuts will solely price trillions of {dollars}. However even when Republicans use a budgetary calculation to cover the prices, referred to as the present coverage base, they’ll nonetheless must discover a path for brand spanking new coverage that eliminates taxes on suggestions, additional time and social safety controls of pensioners.

Strolling load on the ultra-rich also can serve to convey Democrats to a tough political state of affairs by forcing them to decide on between supporting Trump’s coverage and resisting an concept that they’ve been pushing for years.

Home Majority Chief Steve Scalise can be towards lifting taxes on the wealthy (Reuters/Mike Segar)

The most effective earnings tax price is presently round 37% at $ 609,351 in earnings for a single individual or $ 731.201 for married {couples}.

However rising the speed for millionaires is usually a strategy to pay for Trump’s new tax coverage.

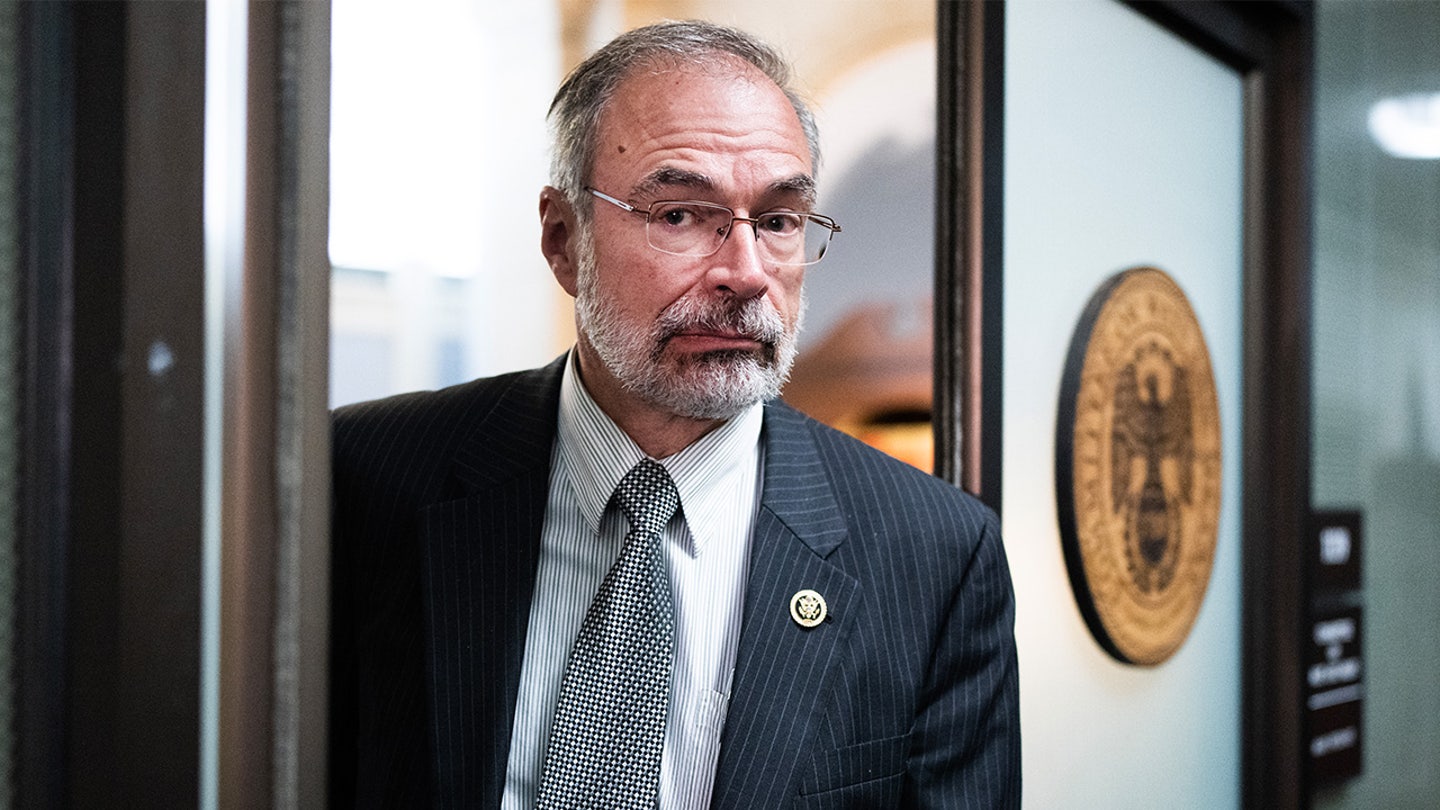

Huis Freedom Caucus chairman Andy Harris, R-MD., One of many shortages of the lead to make sure that new editions are accompanied by deep cuts elsewhere, stated: “That could be a chance.”

“What I want to do is that I would love to seek out bills elsewhere within the price range, but when we can’t get sufficient expenditure reductions, we should pay for our tax reductions final week,” Harris stated “Mornings with Maria”.

“Earlier than the tax cuts and job regulation was the best tax bracket 39.6%, it was lower than $ 1 million. Ideally, what we may do, once more, if we can’t discover expenditure reductions, we are saying:” Okay, let’s restore that greater bracket, allow us to set it to maybe $ 2 million earnings and above, “to assist pay” “” “”

However Johnson’s nr. 2, Majority Chief Steve Scalise, R-La., Gooted chilly water once more on Tuesday.

“I don’t help that initiative,” Scalise stated “mornings with Maria,” though he added: “The whole lot is on the desk.”

Residence freedom Caucus chair Andy Harris gave openness to the thought (Getty Pictures)

“That’s the reason you hear all of the concepts which are bumped round. And if we don’t take motion, you’ll see greater than 90% of People a tax improve,” Scalise warned.

Bloomberg Information was the first to report Home republicans of 40% tax will increase.

Click on right here to get the Fox Information app

When the White Home was reached, the White Home Fox Information Digital pointed to feedback from press secretary Karoline Leavitt earlier on Tuesday when she stated that Trump had not determined to extend the speed of company tax.

“I offered this concept. I’ve heard this concept. However I do not consider that the president has made a willpower whether or not he helps it or not,” Leavitt stated.

Fox Information Digital additionally reached Johnson’s workplace for remark.

-

Michigan1 month ago

Michigan1 month agoUS District Judge rules that President Trump can dismantle USAID

-

National News4 weeks ago

National News4 weeks agoWATCH LIVE: Stranded NASA astronauts heading back to Earth in SpaceX capsule

-

Michigan1 month ago

Michigan1 month agoPresident Trump’s Address to Congress – Key Takeaway

-

National News3 weeks ago

National News3 weeks agoHomeland Security Sec Kristi Noem visits notorious El Salvador prison

-

Michigan3 weeks ago

Michigan3 weeks agoTrump’s new 25% auto tariff policy: Read what it says

-

Oakland County1 month ago

Oakland County1 month agoLegendary Oakland artist D’Wayne Wiggins of Tony! Toni! Toné! dies at 64

-

Michigan2 months ago

Michigan2 months agoMichigan forest worker hoped Trump’s victory would change her life, but not like this

-

Oakland County2 months ago

Oakland County2 months agoOakland has been paying too much overtime to city workers, watchdog reports