Michigan

Detroit’s next mayor will need to get creative to sustain momentum

Tips on how to register to vote in Michigan: Step-by-step information

Registering to vote in Michigan is straightforward and might be performed on-line, by mail, or in individual, relying on how shut you’re to Election Day.

- Detroit’s mayor was tasked with balancing the finances and bettering metropolis providers following municipal chapter.

- Town’s subsequent mayor can have a stable monetary monitor to work with, consultants say, however might want to strategize methods to spend money on the town with out hurting its core providers.

- Mayoral candidates Mary Sheffield and Solomon Kinloch Jr. have plans to develop revenues or search help to launch new applications.

As Detroiters gear as much as vote for a brand new mayor and metropolis council, questions loom concerning the metropolis’s long-term monetary resilience following its emergence from a historic chapter and 12 years of leaders mining for sources to proceed restoring the as soon as fiscally-mired city right into a thriving city space.

Detroit as soon as was affected by a scarcity of dependable metropolis providers, with a number of neighborhoods in disrepair. Popping out of chapter in December of 2014, with a largely clear ledger — thanks primarily to the “Grand Cut price” funding plan and a few severe and painful belt-tightening by a state-appointed emergency supervisor— Mayor Mike Duggan, who took workplace in January of 2014, had the problem of placing the items again collectively.

By suits and begins, Detroit has managed to revive providers, appeal to new developments and largely regain its monetary footing, sustaining a balanced finances for 12 years that has concurrently allowed it to develop its reserves to $502 million.

This features a $150 million Wet Day Fund, a $281 million Retiree Safety Fund (to cowl pension obligations) and a $71 million Danger Administration Legal responsibility Fund. All of that has helped to extend the town’s bond ranking to its highest tier — Baa1 — since 1999. New and refurbished housing, retail and enterprise area has helped. And Detroit additionally lately noticed its first inhabitants enhance after many years of decline and no less than 9 years of property worth will increase.

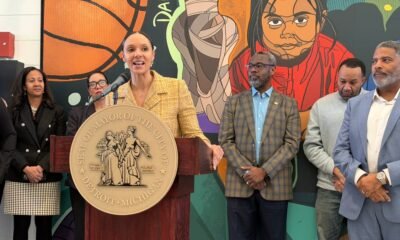

One of many greatest challenges for the town’s subsequent mayor, whether or not that’s present Detroit Metropolis Council President Mary Sheffield or the Rev. Solomon Kinloch of Triumph Church, might be preserving that optimistic momentum going and constructing upon it — significantly because it pertains to the town’s greater than 200 neighborhoods. Whereas some neighborhoods have gotten consideration, the progress has been uneven and is not reaching the identical vital mass of improvement and redevelopment success that has benefited the downtown space and its surrounds.

Each candidates to interchange him have articulated concepts for investing in neighborhoods and making certain inhabitants development. However Rip Rapson, president and chief govt officer of the Kresge Basis, which helped fund a number of initiatives in Detroit, together with the Grand Cut price deal that helped lead the town out of chapter, mentioned Detroit’s monetary future is extra difficult and would require thought over which instruments are most promising to meet their visions “and the way does Metropolis Corridor then join with the people who find themselves doing that work?”

“It should be greater than cash. I feel it will be the flexibility to make sure that we will match capital with the sorts of rising wants {that a} metropolis like Detroit has,” together with neighborhoods stuffed with alternatives — entry to good training and jobs, small enterprise corridors serving the each day wants of Detroiters, sufficient transportation and baby care, Rapson added.

They usually possible must be inventive, as a result of spreading that downtown success throughout the remainder of the town’s 130-plus sq. miles might be a problem, significantly with cuts to federal funding that Detroit and different states and municipalities have been utilizing to assist fund issues from infrastructure to neighborhood improvement initiatives, forcing them to interchange these {dollars} on their very own.

To take care of monetary momentum, Detroit’s subsequent mayor, as former finances director Steve Watson put it, might want to proceed embracing a structurally balanced finances, or making certain the town’s recurring spending and revenues are equal to at least one one other, and keep away from utilizing one-time funding — both the prior yr’s surplus or grants — to pay for recurring bills.

Detroit’s chapter “didn’t occur in a single day. It was the assembly of inhabitants loss, income loss, state income sharing cuts and the town digging a deeper gap the place the town began borrowing to pay for normal operations. That is a gap you may by no means dig your manner out of, and it led to a really painful chapter course of so as to right-size metropolis funds,” Watson mentioned.

A glance again by means of chapter

Duggan’s massive issues as the town emerged out of chapter had been restoring primary metropolis providers, the pension funding cliff and balancing the finances with out overextending the town’s limits. Detroit posted conservative income estimates for a number of years to make sure that any recurring spending — which is cash the town wants annually for bills — is balanced with the recurring revenues. These estimates additionally think about issues like inflationary development, projected pay raises for metropolis staff and commonplace value and inflation pressures in authorities.

Legacy pension funds, which resumed within the 2024 fiscal yr, had been on the prime of thoughts for Duggan, whose administration established an almost $455 million Retiree Safety Fund over time. The belief fund is for pension funds solely, prohibiting officers from diverting that cash elsewhere, Watson mentioned.

“Popping out of the chapter, the pension cliff actually did current a monetary existential risk to the town. It was shopping for away one of many greatest finances challenges the town was going to face. Town had 10 years to cope with it … in 2024, the town would go from paying zero {dollars} towards its pension plan to $150 million or extra per yr, that’s why we known as it a cliff,” Watson mentioned.

Town’s technique was to steadily section in contributions in a “manageable manner,” which ought to be performed by the early 2030s, Watson mentioned. Officers started setting apart surplus {dollars} to fill the Retiree Safety Fund beginning round 2016-17. The objective is to construct capability within the finances over time and depend on revenues to make these contributions.

“The present plan reveals strain on the town finances for an additional $3 to $4 million yearly, and that’s very manageable,” Watson mentioned.

Budgetary troubles ensue when authorities officers try to stability a finances based mostly off a one-time windfall, hoping to discover a resolution within the following yr to resolve that subject, Watson mentioned, emphasizing the Duggan administration particularly tried avoiding that with the inflow of federal funding throughout his closing time period.

Detroit obtained $826 million in American Rescue Plan Act cash, which some cities — not Detroit — poured into their basic funds to stability their budgets. It might be a straightforward resolution till metropolis officers would later be tasked with figuring out the place to seek out cash for these recurring bills for later years. Detroit already confronted spending cuts throughout all departments by lowering worker hours in the course of the COVID-19 pandemic — as many governments did — and commenced restoring these cuts as soon as the town’s personal tax revenues, together with revenue and on-line gaming taxes, started rebounding.

Earnings taxes from the town’s newest $3 billion finances reached $465 million. Earnings taxes had been $250 million when the town got here out of chapter in December of 2014, Watson mentioned. On-line gaming taxes additionally jumped from $187 million — at its peak earlier than the pandemic — to a projected $290 million for this fiscal yr.

“Being a metropolis that had gone by means of chapter, the considering on the time was like, ‘Nicely yeah, we will not afford to tackle that massive of a finances danger by relying on these federal {dollars} to stability the finances,’ ” Watson mentioned, including that the town perceived federal ARPA funding authorized throughout President Joe Biden’s administration as a solution to fast-track capital and infrastructure initiatives. “Will there be some applications the town will wish to proceed? Perhaps. Nevertheless it’ll be on the town to seek out these sources. All of the ARPA applications had been designed that in the event that they wanted to be shut off, they may very well be,” Watson mentioned.

Trying forward, the finances is in a wholesome place and maintaining with rising prices of primary providers, in line with Watson. Duggan mentioned the town is presently doing nicely financially at an announcement proposing to make use of some surplus funds to create a brand new reserve fund to offset falling company taxes, decreased by the signing of President Donald Trump’s “Huge Stunning Invoice.”

“Each time we see a danger, we face it and we deal with it, which is why we maintain operating surpluses and why we maintain getting credit score upgrades. I don’t see any others proper now, however issues are unpredictable on this nation proper now,” Duggan mentioned, touting a number of main developments, together with auto crops, throughout the town, and added that the auto business must be vibrant long run to ensure that the town to stay vibrant.

The following problem for the brand new mayor might be labor negotiations with the town’s unions for bus drivers, fireplace, EMS and police.

“That provides some further uncertainty, however that’s one thing the town is clearly nicely conscious is coming and getting ready for financially,” Watson mentioned. “In the course of the finances, in the previous few cycles, the town has been proactive about setting apart cash and recurring finances cash right into a Workforce Investments Account … that manner, no matter that deal finally ends up being, it’s not a scramble to look the finances for more money to cowl it … the town is definitely constructing in capability within the finances to handle these proactively.”

Jeffrey Pegg, a board of trustee member for the Police and Fireplace Retirement System, just isn’t involved concerning the metropolis making its funds. However, he mentioned, he’s fearful about legacy pensioners changing into unsustainable for the town.

“A man like myself, with virtually 30 years on job, goes to obtain a pension that’s 45% of my pay, which, with out Social Safety … just isn’t one thing that I can reside off for the remainder of my life. I level that out at each assembly. As a board of trustees, all people acknowledges it and sees the issue … metropolis people throughout the desk, they see it as being a problem. But, in relation to the union facet negotiating it, the town says we don’t have some huge cash for these enhancements,” Pegg mentioned.

Pegg added that an worker employed after July 2014 will obtain a pension at 60% of their pay, however he and his colleagues are vying for one thing “higher.”

“The one resolution is to place extra money in the direction of pensions out of the town’s finances. That’s one thing that hopefully this new mayor goes to handle,” Pegg mentioned. “Pension is so essential since you need to have the ability to retain good individuals, and offering a very good profit will do this.”

Muneer Islam, president of AFSCME Native 312, which represents DDOT mechanics and upkeep employees, mentioned their contract expired in July 2024, however he hopes the union can renew it earlier than Duggan is out.

“We simply wish to be aggressive with the competitors — SMART, and the opposite transit techniques within the area. The first is wage, sure,” Islam mentioned. “We’re shedding lots of people to SMART and a whole lot of (these different) transportation techniques.”

Islam added that the union is vying for $10-$15 hourly wage will increase to compete with the opposite transit techniques.

“I simply hope the town takes it significantly earlier than he (Duggan) leaves, as a result of DDOT was a kind of issues that simply looks like it went type of by the wayside to an extent. Hopefully, (Duggan) can look into it earlier than he leaves. You don’t wish to go away a large number for anyone simply coming in to cope with and he’s aware of DDOT,” Islam mentioned.

What’s hanging in Detroit’s future?

Moreover sustaining a structural finances stability and persevering with with pension obligations, Detroit’s subsequent mayor ought to strategize about what to do when it comes to metropolis providers, applications and investments in the neighborhood, all whereas figuring out funding methods that don’t impair core metropolis providers, Watson mentioned.

“Perhaps there’s partnerships with philanthropy. The state and federal authorities won’t be the simplest supply to go to, however with the present monetary resilience, the town can begin counting on itself,” Watson mentioned, including that the following mayor might contemplate ultimately learning whether or not to return to voters to pursue a bond subject to spend money on metropolis property, equivalent to leisure areas, infrastructure or amenities like police precincts and firehouses.

Detroit’s strong philanthropic sector has bankrolled quite a few initiatives throughout the town, and the following mayor will should be keen and comfy sufficient to work with totally different sectors to fill subsidy gaps or present the “final mile lending” into neighborhoods of curiosity, Rapson mentioned.

“On the finish of the day … I do not imply to deify him, however we’d like a model of Duggan. We want somebody who is concentrated on problem-solving as a result of this equipment is about to get damaged by the federal authorities. The federal authorities is about to go away the constructing fully. And I feel we do not absolutely perceive simply how advanced and difficult that is going to be,” Rapson mentioned. “It is not a lot who has the massive imaginative and prescient; not a lot who has the best charisma; it is who can we put in that slot who can handle a unique existential disaster from something we have actually had.”

That kind of civic problem-solving would require Detroit’s subsequent chief to navigate working with philanthropy, community-based choice making, and anybody else who’s a keen accomplice.

Duggan “went out of his solution to simply contact each a part of the town, and he emphasised, at all times, that all the neighborhoods of the town should be important,” Rapson mentioned. “Whoever we flip to has obtained to be a supremely good supervisor as a result of the transferring components are coming all aside.

“All the pieces we rely on as a municipal mannequin of excellent governance and considerate funding goes to be challenged.”

Detroit’s subsequent mayor additionally might be compelled to proceed incremental investments in metropolis providers and neighborhood infrastructure. Doing so might imply a possible bonding plan that may return to voters if the town needed to pay for investments with a millage. Devising methods to spice up tax income and financial development, enhance inhabitants by attracting new employers, improvement and probably property tax reform — which has burdened residents with excessive taxes — additionally stay hanging for the following mayor to resolve.

Imaginative and prescient of Detroit mayoral candidates

Sheffield has adopted 12 budgets throughout her tenure on council. In an emailed assertion to the Free Press, she mentioned she has carried out “tight fiscal controls” in working with the Duggan administration, and is ready to tackle main gadgets, together with persevering with pension funds, with none disruptions to the town’s providers.

Sheffield additionally touted Detroit’s upgraded bond ranking from Moody’s Funding Companies as a “large vote of confidence within the measures and controls that we’ve carried out to make sure solvency.” However, Sheffield mentioned, she just isn’t happy with merely persevering with present progress. “I may even construct upon this basis, even additional increasing the monetary oversight, expertise and capability inside the CFO’s Workplace beneath my administration. I plan to develop Detroit’s income and inhabitants with innovation and finest practices,” Sheffield mentioned. “Not too long ago, I’ve highlighted the potential of a half-penny tax, leisure tax and different amusement or tourism tax levers.

“However my Chief Development Officer will recruit native and nationwide experience to totally analyze all of our choices. They are going to present instruments and suggestions for max income positive factors and minimal unfavorable impacts on Detroit residents, and we’ll assess and design a closing implementation plan alongside our consultants and with our residents.”

Sheffield mentioned the town must be “fiscally disciplined” and have the foresight of addressing potential impacts on the finances, utilizing Duggan’s latest proposal to determine a company revenue tax reserve fund for example of how his administration ready early on for a possible downfall. She mentioned she, too, plans to discover methods to generate income.

“We all know which you could’t tax your manner out of something. I feel these concepts of native gross sales choice taxes and leisure taxes, and excise taxes, no matter they could be, these are instruments to assist scale back property taxes however they’re not the top resolution. So we’ve to proceed to draw rising industries, good-paying jobs for Detroiters, as a result of after we get individuals employed, we get extra income by means of revenue taxes. We wish to develop our inhabitants by making certain that we additionally get property taxes,” Sheffield mentioned.

Kinloch warns in opposition to throwing across the concept of an leisure tax to keep away from burdening residents with one other potential tax — on prime of the town’s already excessive property taxes.

“We want to try retooling all the tax construction. Now we have to be trustworthy about that. That is going to take the state Legislature. It should take the vote of the residents. It should take the vote of metropolis council,” Kinloch mentioned. “Now we have to seek out sensible methods to present individuals aid now whereas we’re engaged on these long-term options.”

Sheffield added that her administration would suggest a package deal to the state involving a number of instruments to cut back property taxes.

“Even in the event you took the leisure tax alone … and you set it on the highest quantity, it nonetheless wouldn’t generate sufficient income for residents to have a considerable influence on their property tax discount. Primarily based on different main cities, we must scale back property taxes about 60%, which is about $400 million a yr in income Detroit must discover,” Sheffield mentioned. “Whether or not it’s Land Worth (Tax) and a neighborhood gross sales choice tax, or no matter it might be, we’ve to determine what these three or 4 instruments are, package deal it up in a invoice and go to Lansing and advocate for it.”

Kinloch added that retooling the tax construction will contain analyzing particular tax districts.

“Now we have to confront the truth that we’ve obtained a story of two cities: You bought downtown and you then obtained the remainder of the city. And we have to find out whether or not alternatives exist to recapture a few of that misplaced tax income value,” Kinloch mentioned. “We wish to make it clear that my administration will at all times be receptive and open to working with individuals and entities, foundations and firms which are keen to spend money on the well-being of the town. However we do not need guarantees made, and guarantees not stored.”

Kinloch mentioned he expects to right away “cease the drain of Black middle-class Detroiters” from leaving the town to assist enhance revenues. His plan consists of prioritizing housing and restorations for working households, fast-tracking the allowing course of for reasonably priced housing improvement, offering down cost help and low-interest mortgage applications, and creating grants and incentives for house repairs, although he did not establish the place these funds would come from.

Kinloch mentioned he plans to work with the enterprise and philanthropic communities to hunt help to launch — what he mentioned he expects could be — the most important down cost help and low-interest mortgage program within the metropolis to assist working households buy their first house. He additionally identified that the finances is a mirrored image of metropolis priorities. And to maintain prices down, he mentioned he would look to focus improvement on underutilized or vacant land owned by the town and Detroit Land Financial institution Authority to cut back acquisition prices and set up neighborhood land trusts.

Kinloch additionally mentioned he would launch a “Rent Native” initiative to supply tax incentives to metropolis employers who rent and retain Detroit residents making dwelling wages. Companies taking part within the metropolis’s procurement course of with Detroit staff additionally would obtain factors towards their bid scores, boosting their benefit within the bid award course of beneath a Kinloch administration.

“I imagine one of many biggest keys to that’s investing in our small companies. After we take a look at the truth that we obtained greater than 38,000 small companies, incentivizing them hiring Detroiters, incentivizing these Detroiters that do not reside within the metropolis to maneuver to the town, to remain within the metropolis,” Kinloch mentioned. “Now we have to make it possible for we’re partnering with the people who find themselves already on the bottom doing the work.”

Dana Afana is the Detroit metropolis corridor reporter for the Free Press. Contact: dafana@freepress.com. Observe her: @DanaAfana.

-

Michigan12 months ago

Michigan12 months agoUS District Judge rules that President Trump can dismantle USAID

-

Macomb County10 months ago

Macomb County10 months agoWho’s running for Michigan’s 10th Congressional District?

-

Michigan10 months ago

Michigan10 months agoWhen is Holland’s tulip festival? What to know about the west Michigan event

-

National News11 months ago

National News11 months agoWATCH LIVE: Stranded NASA astronauts heading back to Earth in SpaceX capsule

-

Michigan12 months ago

Michigan12 months agoPresident Trump’s Address to Congress – Key Takeaway

-

Michigan10 months ago

Michigan10 months ago5 common Michigan snakes you may see as the weather warms

-

Michigan10 months ago

Michigan10 months agoMichigan hunter? Here’s a list of the hunting seasons for 2025

-

Oakland County9 months ago

Oakland County9 months agoLa Loulou brings a slice of Paris to Piedmont Ave., Cafe Noir moves to Prescott Market