Macomb County

Michigan marijuana businesses, customers see hazy future with new tax

By Candice Williams, cwilliams@detroitnews.com

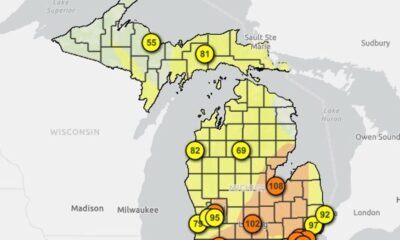

Hashish dispensaries in Metro Detroit say gross sales have elevated in latest weeks as prospects refill in anticipation of a brand new 24% tax that takes impact Jan. 1.

The gross sales improve displays a mixture of ongoing taxes, Christmas present giving and better consumption across the finish of the 12 months, retailers say.

“We’re seeing individuals are available and refill,” stated Jerry Millen, proprietor of Greenhouse of Walled Lake. “We have got individuals coming from out of state. I feel you see lots of people proper earlier than Christmas and New Yr’s. We’re beginning to see it now.”

One factor looming for the trade is the brand new adult-use hashish tax, authorised as a part of the state’s highway funding package deal that kicks in on January 1. The tax applies on the wholesale stage, however some customers fear it might result in greater costs on the checkout.

“There may be in all probability some concern among the many buyer base concerning the highway tax and its influence on costs in 2026,” stated Adam Saj, vice chairman of provide chain and assist companies for Lume Hashish Co., which has 39 dispensaries in Michigan. “In late September, as information broke about Home Invoice 4951, we noticed a notable improve in October. As we method the brand new 12 months, we count on this to occur once more.”

The tax, constructed into the Complete Street Funding Tax Act, applies when marijuana is first bought or transferred to a retailer and is separate from the present 10% excise tax on leisure marijuana and the 6% state tax customers pay on purchases.

Lawmakers say the brand new tax is predicted to boost $420 million yearly for highway and infrastructure repairs. Hashish corporations and trade teams have opposed the tax, saying it is going to drive up costs for customers and put strain on an trade already dealing with falling costs and consolidation. The Michigan Hashish Business Affiliation, which represents about 400 licensed marijuana companies, has fought the case in court docket, however thus far the tax is predicted to enter impact as deliberate after a Michigan Courtroom of Claims choose upheld its legality this month.

“We stay steadfast in our perception that when the Legislature imposed this 24% wholesale tax, it violated the need of the voters who authorised the 2018 Citizen Vote Initiative,” MiCIA spokesperson Rose Tantraphol stated in an e-mail.

Tantraphol stated the affiliation is working with its legal professionals to finalize an enchantment towards Choose Sima Patel’s ruling, who stated the brand new wholesale tax invoice was “constant” with the textual content of the poll measure, which acknowledged “different taxes.”

Tantraphol stated hashish prospects have stated they really feel like their {dollars} are already gone, they usually’re not keen to spend extra.

“Companies will shut,” she stated. “Our neighbors will lose jobs. The wholesale tax shouldn’t be but in impact, and already one hashish enterprise in Webberville will shut, one other has informed us it is going to shut quickly, and one enterprise within the Higher Peninsula completely laid off 61 staff this week.”

How prospects reply

Maddie Fowler, 23, of Royal Oak, stated she was involved concerning the potential influence the tax might have on costs. She lately stopped by Lume in Berkley to buy a weed cartridge and vape pen.

“Primarily disappointment, as a result of it was already a giant battle to get it legalized…,” she stated. “It is similar to, let’s make it dearer. It was type of irritating to listen to.”

Fowler stated she has no plans to purchase in bulk earlier than the tax is imposed, however she plans to pay nearer consideration to her purchases.

Lume’s Saj stated the corporate is conscious of considerations concerning the new tax however is working to maintain prices manageable for purchasers.

“Will costs rise in 2026? Sure, however not by this terrifying 24%,” he stated. He added that Lume is coping with suppliers who’re keen to soak up a few of the prices, making the will increase smaller than some customers would possibly count on.

Saj inspired prospects who’re involved to go to Lume shops earlier than the tip of the 12 months in the event that they wish to refill. He stated there could also be a couple of gadgets that may see little to no value improve in 2026. For instance, a $10 merchandise might improve by a greenback, he stated.

Fowler stated she is inspired that the worth will increase might not be as excessive as she anticipated, however she nonetheless worries about how pharmacies will cope.

“That is my favourite place to go, however that could be a concern,” she stated. “I assumed, like a number of pharmacies, I am questioning in the event that they’re making sufficient cash to start with, or if they’ll type of mitigate these prices.”

Duane Byers, 62, of Detroit, stated he plans to take issues week by week. He lately stopped by Lume in Berkley for some pre-rolls.

“It hasn’t hit me but as a result of it hasn’t began but,” he stated. “So I will in all probability get a shock after I come right here subsequent month and see how a lot additional it is going to be. I will in all probability make some modifications as a result of if it will get much more then I will in all probability have to consider how I purchase differently.”

Byers stated even small will increase can add up.

“In the event you’re shopping for $50 and $60, now you are an additional $6 or $7,” he stated. “It isn’t that a lot if you happen to purchase a small merchandise, however if you happen to purchase a giant merchandise it is going to look extra necessary.”

Firms are gearing up

In Walled Lake, Greenhouse plans to lean extra on its medical marijuana license whereas adopting the brand new 24% wholesale tax, which doesn’t apply to medical hashish. Millen stated he expects some prospects who let their medical licenses expire will renew them to keep away from greater costs for leisure merchandise.

“It’s totally tough to get medical merchandise now, however we’ve a fairly intensive assortment of medical merchandise,” Millen says. “And the great factor about the way in which the Kas is about up is that I’ve two separate rooms. I’ve a recreation room and a medical room, so you do not have to attend in line of 500 individuals on the recreation facet.”

To cut back the influence of the tax, Millen stated earlier this 12 months he bought a hashish cultivation firm and renewed each its medical and leisure cultivation licenses, permitting Greenhouse to supply its personal medical bud.

Millen stated he doesn’t plan to extend the costs of his merchandise till completely vital.

“I am not attempting to boost costs for the following three, 4 or 5 months, I hope,” he stated. “That is my hope. That is why I spent all this cash on flowers to cross the financial savings on to the patron.”

Nick Hannawa, vice chairman and co-owner of Puff Hashish, stated prospects are getting ready for the brand new tax and the corporate has positioned massive orders to maintain costs low for now. The corporate has 13 pharmacies in Michigan.

Hannawa criticized each the tax and the Legislature’s rollout, calling it unclear and leaving extra questions than solutions about how the tax shall be collected.

“This might get actually messy,” he stated. “We’ve requested the (Hashish Regulatory Company) for recommendation. They’re attempting to present us recommendation.”

Hannawa stated hashish corporations in Michigan already function on skinny margins and face intense competitors. He stated bigger corporations like Puff could possibly climate the change, however smaller companies may very well be hit arduous. It might additionally probably spur extra black market exercise, he stated.

“What Puff will do is we, together with our companions, will proceed to combat for reforms to reverse this,” he stated. “I am positive it will go all the way in which to the Supreme Courtroom. So we hope to maintain combating.”

Regardless of the issues, Millen stated he expects Michigan’s hashish trade to proceed: “It isn’t going to kill the trade. The trade is doing effectively. The buyer on the leisure facet goes to must pay slightly bit extra, however it is going to occur.”

Byers, the Lume buyer, felt the identical means.

“I do not suppose anybody will cease,” he stated. ‘As a result of most individuals who smoke proceed to smoke.’

-

Michigan12 months ago

Michigan12 months agoUS District Judge rules that President Trump can dismantle USAID

-

Macomb County10 months ago

Macomb County10 months agoWho’s running for Michigan’s 10th Congressional District?

-

Michigan10 months ago

Michigan10 months agoWhen is Holland’s tulip festival? What to know about the west Michigan event

-

National News11 months ago

National News11 months agoWATCH LIVE: Stranded NASA astronauts heading back to Earth in SpaceX capsule

-

Michigan12 months ago

Michigan12 months agoPresident Trump’s Address to Congress – Key Takeaway

-

Michigan10 months ago

Michigan10 months ago5 common Michigan snakes you may see as the weather warms

-

Michigan10 months ago

Michigan10 months agoMichigan hunter? Here’s a list of the hunting seasons for 2025

-

Oakland County9 months ago

Oakland County9 months agoLa Loulou brings a slice of Paris to Piedmont Ave., Cafe Noir moves to Prescott Market