Michigan

Tax changes will make Social Security go insolvent sooner than previous estimate

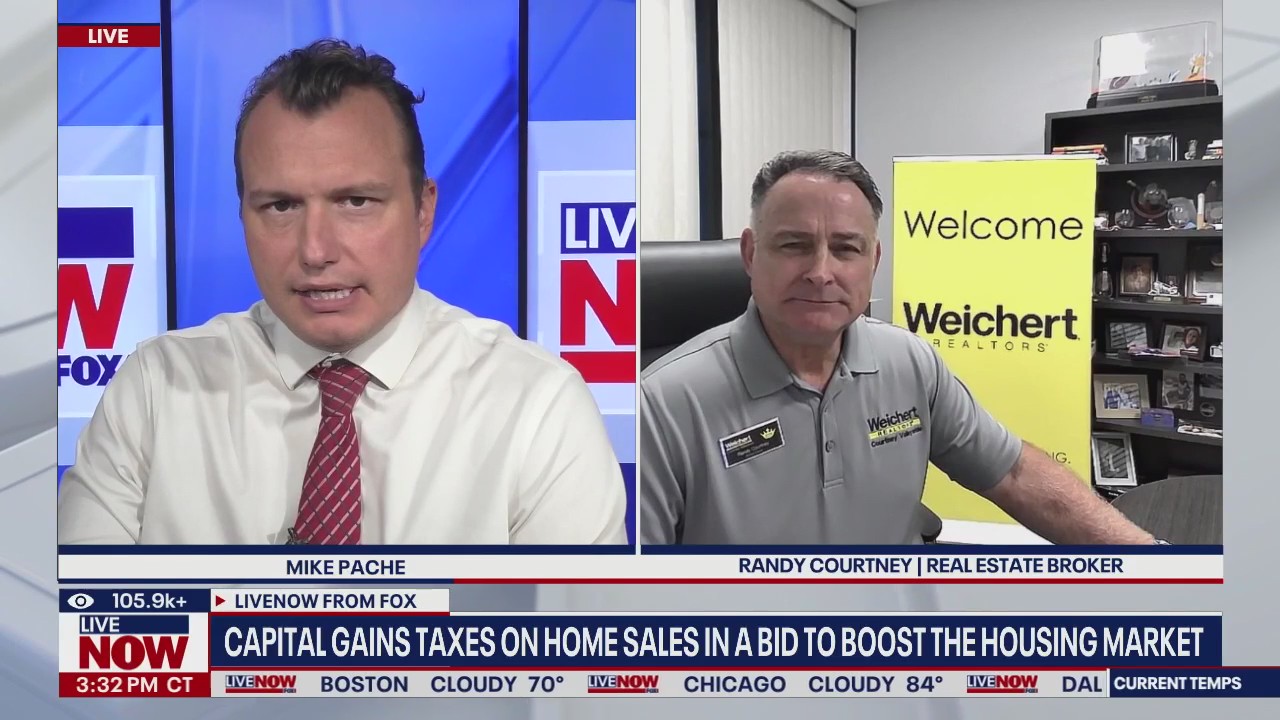

Trump is considering terminating the power gain tax on houses

LIVENOW’s Mike Pache interviews actual property agent and proprietor, Randy Courtney, a part of Weicert Realtors-Courtney Valleywide with regard to Trump that weigh the trouble to take away the tax on the house.

One of the best actuary for Social security Belief funds on Tuesday confirmed that the bancrupt date of these funds has risen because of the lately sown tax and expenditure package deal, in order that coverage makers have rather less time to stabilize the funds of this system.

The workplace of the Chief Actuary for Social Safety despatched a letter in response to an investigation by the Ron Wyden rating, D-Or., Concerning the impact of the One Huge Stunning Invoice Act (OBBBA) on the belief funds of the security internet program.

Chief Actuary Karen Glenn defined within the letter that the everlasting lower income tax ratesIn addition to non permanent modifications to the quantities of sure normal and specified deductions – such because the quickly improved normal deduction for seniors – could have “materials results on the monetary standing of the Social Safety Belief Funds”.

Glenn wrote that within the following decade, Obbba will improve the online prices for the Oasdi belief funds of social safety by round $ 168.6 billion, and the “timing of mixed OASI and Di Belief Fund is extracted from the third quarter of 2034 of the subsequent quarter of the subsequent quarter of the subsequent quarter of the subsequent quarter of the subsequent quarter of the subsequent quarter of the subsequent quarter of the subsequent quarter” Trusteese’s report “”

The belief funds of social safety are on the best way to insolvency in lower than a decade because of the improve within the relationship between pensioners and lively workers. (Photograph -Ilustration by Kevin Dietsch / Getty pictures / getty pictures)

Based on present federal laws, the advantages paid underneath social safety are restricted to incoming wage taxes and advantages of the belief funds, and their threatening insolvency in lower than a decade entitles beneficiaries at risk to computerized advantages reductions resembling Congress and the White House Don’t strengthen the funds of this system.

An evaluation of the non -party -bound fee for a accountable federal finances (CRFB) confirmed that social safety advantages could be confronted with an computerized discount of 24% on the time of insolvency on the finish of 2032, 62 million Americans.

The evaluation of CRFB confirmed that for a number of with double incomes with a median household revenue that retires initially of 2033, which might be 24% a discount on an annual discount in the advantages of $ 18,100, or a month-to-month discount of round $ 1,509. A couple of with one revenue on that revenue layer, however, would see an annual profit discount of $ 13,600.

President Donald Trump signed one huge stunning Invoice Act within the legislation on July 4, 2025. (Samuel Corum / Getty Photos / Getty Photos)

A couple of with double and low incomes would see an annual profit discount of $ 11,000, whereas a number of with one incomes would see the advantages fall by $ 8,200 through the yr, CRFB thought.

For households with a excessive revenue, a number of with double revenue advantages of $ 24,000 a yr could be confronted, whereas a number of with one revenue would have advantages with $ 18,000 for the yr, in line with the evaluation.

Over time, the profit reductions will deepen as the expansion within the prices of social safety continues to exceed incoming revenue, as a result of CRFB would rise to greater than 30% by 2099 to greater than 30%.

“Coverage makers who promise to not contact social safety implicitly endorse these deep advantages for 62 million pensioners in 2032 after which,” stated CRFB. “It’s time for coverage makers to inform the reality in regards to the funds of this system and to pursue options from belief funds to regulate insolvency and to enhance this system for present and future generations.”

LINK: Receive updates and more on Foxbusiness.com.

-

Michigan11 months ago

Michigan11 months agoUS District Judge rules that President Trump can dismantle USAID

-

Macomb County10 months ago

Macomb County10 months agoWho’s running for Michigan’s 10th Congressional District?

-

Michigan10 months ago

Michigan10 months agoWhen is Holland’s tulip festival? What to know about the west Michigan event

-

National News11 months ago

National News11 months agoWATCH LIVE: Stranded NASA astronauts heading back to Earth in SpaceX capsule

-

Michigan11 months ago

Michigan11 months agoPresident Trump’s Address to Congress – Key Takeaway

-

Michigan10 months ago

Michigan10 months ago5 common Michigan snakes you may see as the weather warms

-

Michigan10 months ago

Michigan10 months agoMichigan hunter? Here’s a list of the hunting seasons for 2025

-

Oakland County9 months ago

Oakland County9 months agoLa Loulou brings a slice of Paris to Piedmont Ave., Cafe Noir moves to Prescott Market