Michigan

What a Detroit sales tax would raise, and who pays

Nationwide consumption tax defined: predominant variations with earnings tax

Within the US, consumption taxes come within the type of retail taxes and excise taxes, in addition to tariffs.

This story was initially printed by BridgeDetroit, an affiliate of the Detroit Free Press.

A new report means that Detroit may elevate between $42 million and $71 million by implementing a 1% gross sales tax, which might value households an extra $167 per 12 months.

The figures come from a examine by the Residents Analysis Council of Michigan on the potential advantages and dangers of native choice taxes. It is the most recent in a single series by commissioned reports by the Detroit Metropolis Council exploring ways to generate new income and scale back the property tax burden on residents. It was shared with the council’s Legislative Coverage Division.

A neighborhood tax may diversify Detroit’s income sources, generate income from guests and make town much less depending on property taxes and state income sharing.

Nevertheless, the trail to enacting a neighborhood tax is “a formidable job,” requiring an modification to the state structure, a neighborhood ordinance and the approval of Detroit voters.

The report notes that Detroit residents are among the many highest-taxed residents within the state. Gross sales taxes are typically regressive and place a higher burden on lower-income households, though they don’t apply to groceries, pharmaceuticals and water, plus spiritual and nonprofit gross sales.

The utmost projected funding raised by a gross sales tax is much lower than what Detroit collects from different taxes and would characterize about 5% of town’s basic finances.

“Given the comparatively small potential complete revenues and the numerous challenges of implementing a one p.c native gross sales tax, native policymakers should determine whether or not the potential new revenues are definitely worth the state and native efforts required to acquire authorization,” senior analysis affiliate Madhu Anderson mentioned in an e mail.

“Ought to they determine to maneuver ahead, town may present an accompanying tax credit score when imposing a brand new native gross sales tax that might straight profit native residents and scale back residents’ total tax burden.”

The CRC has been launched another study last year on an admissions tax on sports activities and leisure venues in Detroit, discovering it may elevate between $14 million and $47 million yearly. CRC President Eric Lupher mentioned the doorway tax could also be higher suited to producing income from elevated financial exercise within the metropolis. An admissions tax would additionally not require a constitutional modification, though it could require state legislative motion and approval from Detroit voters.

“What we discovered by means of this train is that it’s troublesome for town to boost cash from the gross sales tax as a result of it’s troublesome for metropolis residents to buy costly objects that might generate gross sales tax,” Lupher mentioned. “Throughout the metropolis there are automotive dealerships and issues like that. Shopping for a fridge, shopping for a range, main home equipment, issues that value some huge cash, usually metropolis residents should journey out of city to do this.”

Lupher mentioned the shift to on-line buying additionally means fewer purchases could be topic to a possible gross sales tax.

“For all the explanations Chicago and the cities round us use it, it is sensible that Detroit has it in place,” Lupher mentioned. “It does present the chance to export the tax in sure methods, comparable to lodge rooms and nights out, however it additionally brings with it the regressive nature of taxing your personal residents. So there’s a little bit of a push-pull.”

Metropolis information present that earnings taxes introduced in $434 million in 2024, whereas wagering taxes introduced in $259 million, state income sharing contributed $235 million and property taxes introduced in $142 million.

Mayor Mary Sheffield has proposed tax reforms to scale back the burden on residents, presumably changing a property tax minimize with income from new taxes. Anderson mentioned tax reform is “a worthwhile effort.”

“It is sophisticated and it should take lots of transition and work, however as we transfer into the longer term, a few of these issues could possibly be very useful to Detroit’s financial system,” she mentioned.

The Metropolis Council’s curiosity in implementing a gross sales tax on native choices coincides with latest financial progress and the expiration of one-time funding from the federal American Rescue Plan Act.

The pandemic reduction funds will finish in 2026, which “will increase the dedication for town to search out various funding streams to help companies,” the report mentioned.

The report advises Detroit to not pursue adjustments in state legislation with out broad help throughout the state. New information from the College of Michigan suggests different native governments are exploring new income sources and face related considerations about sustaining companies sooner or later.

A 2025 study discovered that about half of native authorities leaders from throughout the state (57%) would help a brand new native tax if given the prospect, however solely 10% supported a gross sales tax.

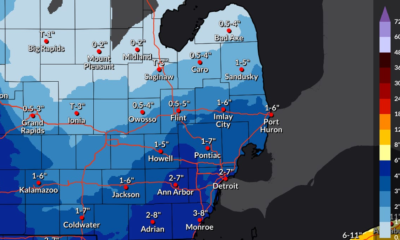

The CRC report states that native gross sales taxes could be higher suited to different densely populated cities comparable to Grand Rapids and Saginaw reasonably than rural townships or villages with much less retail exercise. There could possibly be advantages for vacationer locations all through Michigan, which have a lot bigger populations in the summertime.

Michigan is one in all 13 states that don’t enable native governments to boost native taxes.

Michigan’s 6% gross sales tax charge, which doesn’t embrace native gross sales taxes, ranks thirty eighth within the nation. Seventeen states imposed a mixed state and native gross sales tax charge of seven p.c or extra by 2025.

To obtain common protection from BridgeDetroit, join a free BridgeDetroit e-newsletter here.

-

Michigan11 months ago

Michigan11 months agoUS District Judge rules that President Trump can dismantle USAID

-

Macomb County9 months ago

Macomb County9 months agoWho’s running for Michigan’s 10th Congressional District?

-

Michigan9 months ago

Michigan9 months agoWhen is Holland’s tulip festival? What to know about the west Michigan event

-

National News10 months ago

National News10 months agoWATCH LIVE: Stranded NASA astronauts heading back to Earth in SpaceX capsule

-

Michigan11 months ago

Michigan11 months agoPresident Trump’s Address to Congress – Key Takeaway

-

Michigan9 months ago

Michigan9 months ago5 common Michigan snakes you may see as the weather warms

-

Michigan9 months ago

Michigan9 months agoMichigan hunter? Here’s a list of the hunting seasons for 2025

-

Oakland County9 months ago

Oakland County9 months agoLa Loulou brings a slice of Paris to Piedmont Ave., Cafe Noir moves to Prescott Market