National News

Cruz and Booker urge Fortune 1000 CEOs to support for ‘Trump Accounts’ program

President Donald Trump outlines financial savings accounts for newborns and praises Michael and Susan Dell for supporting the launch of the brand new ‘Trump Accounts’ initiative.

Sens. Ted CruzRep. Cory Booker, D-N.J., R-Texas, urged leaders of Fortune 1000 firms in a letter Tuesday to assist the newly created federal financial savings program often called “Trump Accounts,” a tax-advantaged funding account for new child American youngsters.

This system, created by the One Large Lovely Invoice Act and signed into legislation by the President Donald Trump On July 4, each little one born between January 1, 2025 and December 31, 2028 will obtain a one-time authorities cost of $1,000 at beginning. Households can open an account as soon as the kid has a Social Safety quantity, and the cash can’t be withdrawn till the kid turns 18.

“These stories will launch a once-in-a-lifetime enlargement of financial alternative and prosperity for each American little one, empowering thousands and thousands of households to attain the American dream via homeownership, schooling or entrepreneurship,” the senators wrote.

WHITE HOUSE UNVEILS ‘TRUMP ACCOUNTS’ FOR CHILDREN WITH $6.25B DELL INVESTMENTS

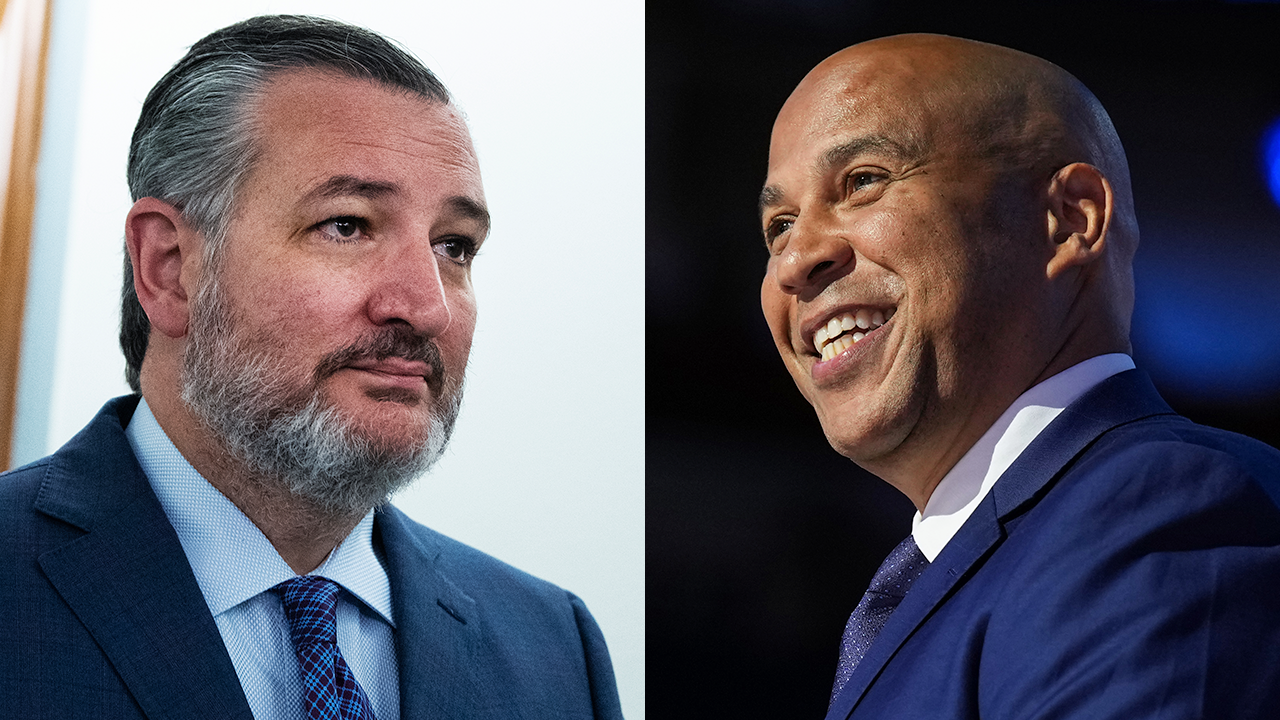

Sens. Ted Cruz, R-Texas, and Cory Booker, D-N.J., led a bipartisan effort to induce the CEOs of Fortune 1000 firms to assist “Trump Accounts.” (Tom Williams/CQ-Roll Name/Andrew Harnik/Getty Photographs)

Senators additionally emphasised the long-term monetary advantages.

“These tax-advantaged accounts be sure that each American little one is a direct shareholder in America’s largest firms and can expertise the miracle of compound development all through their lives,” they wrote.

“We consider these accounts – like 401(ok)s – symbolize a transformative device for constructing long-term monetary safety, growing financial prosperity, and essentially restoring confidence in American capitalism.”

The letter additionally calls on firms to hitch the efforts.

The “Trump Account” is a tax-advantaged account included within the One Large Lovely Invoice Act. (Tim Clayton/Corbis/Getty Photographs)

“Many firms have already pledged assist, and we encourage your organization to discover how one can contribute at a stage that matches your mission and capability. By matching contributions for workers’ households, investing within the communities you serve, or integrating these accounts into your philanthropic technique, you may considerably improve the affect of this historic initiative.”

The decision from each events follows a $6.25 billion funding from Michael Dell, founder and CEO of Dell Applied sciences, and his spouse Susan.

MICHAEL AND SUSAN DELL DONATE $6.25BILLION TO FUND ‘TRUMP ACCOUNTS’

Michael and Susan Dell introduced the $6.25 billion funding in X and later joined President Donald Trump on the White Home. (Andrew Caballero-Reynolds/AFP/Getty Photographs)

The 2 joined Trump on the White Home to share further particulars about their pledge, this system’s first main infusion of personal funding.

“These funding accounts are easy, safe and structured to develop in worth via market returns over time. At age 18, these younger Individuals can have a monetary basis for additional schooling, job coaching, homeownership or future financial savings. It is a easy however very highly effective thought,” the couple stated in an announcement.

Trump referred to as the Dell household’s funding a “nice” and “beneficiant act” and stated he would additionally donate to the federal financial savings program.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The Treasury Division estimates that Trump’s payments might accumulate to a seven-figure steadiness by early maturity as households maximize their contributions.

A completely funded account can quantity to as much as $1.9 million at age 28This was reported by the Workplace of Tax Evaluation of the Ministry of Finance. Even on the decrease finish of anticipated returns, the financial savings account might nonetheless herald virtually $600,000 over the identical interval.

Even with out further contributions past the preliminary $1,000 from the federal authorities depositTreasury estimates the invoice might develop to between $3,000 and $13,800 in 18 years.

-

Michigan12 months ago

Michigan12 months agoUS District Judge rules that President Trump can dismantle USAID

-

Macomb County10 months ago

Macomb County10 months agoWho’s running for Michigan’s 10th Congressional District?

-

Michigan10 months ago

Michigan10 months agoWhen is Holland’s tulip festival? What to know about the west Michigan event

-

National News11 months ago

National News11 months agoWATCH LIVE: Stranded NASA astronauts heading back to Earth in SpaceX capsule

-

Michigan12 months ago

Michigan12 months agoPresident Trump’s Address to Congress – Key Takeaway

-

Michigan10 months ago

Michigan10 months ago5 common Michigan snakes you may see as the weather warms

-

Michigan10 months ago

Michigan10 months agoMichigan hunter? Here’s a list of the hunting seasons for 2025

-

Oakland County9 months ago

Oakland County9 months agoLa Loulou brings a slice of Paris to Piedmont Ave., Cafe Noir moves to Prescott Market