Oakland County

Oakland County officials offer tips for avoiding scams

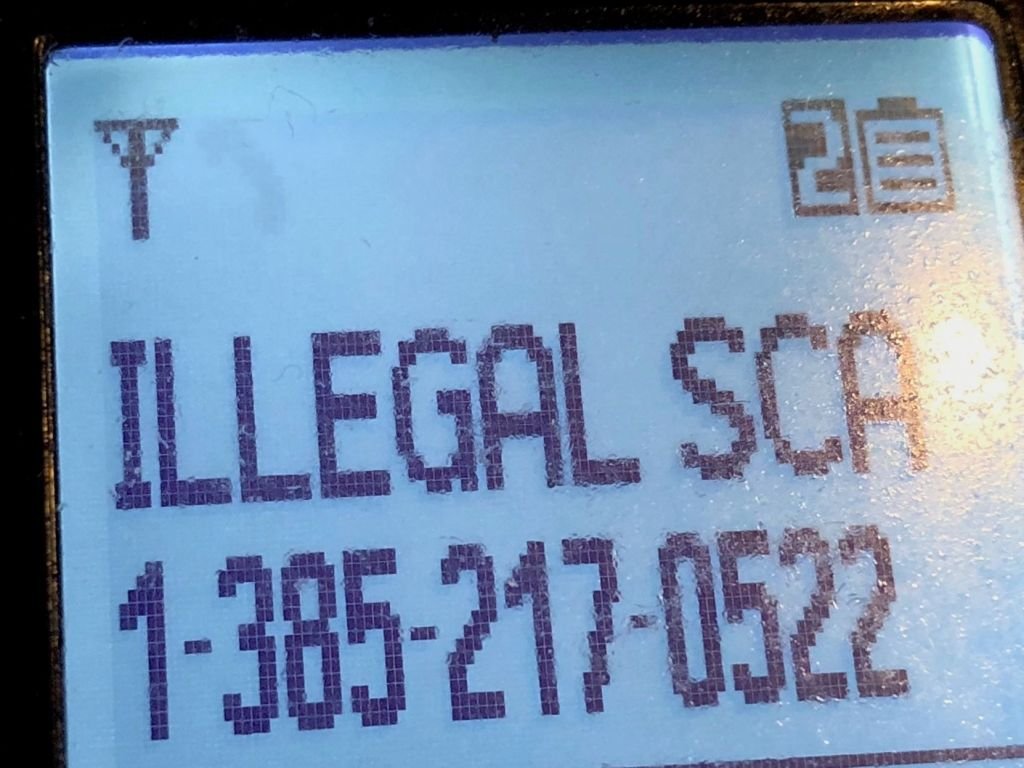

Scammers are getting higher at utilizing textual content messages, cellphone calls and emails to steal cash from their unsuspecting victims.

Oakland County Prosecutor Karen McDonald stated the best factor to do is ignore unknown callers or grasp up. Whereas that recommendation could appear apparent, she says, persistent scammers proceed to catch folks off guard.

Scammers handle to pose as firms, authorities companies and even members of the family. Synthetic intelligence and different know-how make imitating trusted voices or utilizing acknowledged numbers or e mail addresses a lot simpler.

In February, some Bloomfield Township residents fell prey to criminals who claimed they have been owed cash for trash assortment. In July, a 78-year-old Troy man misplaced almost $50,000 to a fraudster and almost $42,000 to a scammer who claimed the sufferer needed to pay for a pc antivirus program. However the sufferer turned suspicious and known as the police.

In March, 68-year-old Oxford Township resident Sandy Selvan misplaced her life financial savings — almost $500,000 — to a scammer posing as actor Mark Harmon.

“It is clear we’re coping with scammers doing jury responsibility and other people posing as cops demanding Venmo transfers and bitcoin,” stated Deputy Tyler Sweers, spokesman for the Oakland County Sheriff’s Workplace. “These persons are at all times attempting issues. Typically they’re chasing love, panic or different feelings.”

McDonald stated scammers have many tips.

“We at all times need to get the perfect out of individuals, particularly at the moment of 12 months,” she says. “Scammers will use your goodwill this season to steal your cash.

McDonald stated folks must be cautious of:

• Discussions about cash, costs, money owed or issues along with your account and an pressing want for fee;

• Threats from the caller of arrest, lawsuits, immigration motion, or disconnection of utilities or advantages if you don’t promptly pay or present data;

• Any requests for delicate data: social safety quantity, date of beginning, financial institution or card numbers, passwords, one-time codes or PINs;

• Any demand for fee with reward playing cards, financial institution transfers, cryptocurrency or apps corresponding to Venmo, Zelle, Paypal or CashApp, or presents to ship a courier to gather money;

• Any provide that appears ‘too good to be true’, corresponding to prizes, refunds or low curiosity loans.

• Callers who’re strangers to you however appear to know the names of members of the family or the place you’re employed, or who use a pleasant tone however change into aggressive once you hesitate;

• Uncommon pauses or background noise

McDonald stated that when you reply such calls, you need to grasp up rapidly, even when you assume you acknowledge the quantity or voice on the opposite finish of the road, particularly if the caller says she or he is in jail or in bother and desperately wants cash. Name one other member of the family to substantiate the primary caller’s declare.

“You do not have to be well mannered to a scammer,” McDonald stated, including that nobody ought to ever share private or monetary data with a caller.

If the caller claims to be out of your financial institution, an organization, or authorities company, grasp up and name again utilizing a quantity out of your assertion, card, or the group’s web site, not a quantity offered throughout the name.

In case you notice you have fallen for a rip-off, contact your financial institution or bank card firm rapidly, she stated, and file a police report.

Good folks nonetheless get scammed, McDonald stated, however disgrace or embarrassment should not hold you from taking motion to guard your self.

Along with altering account passwords, she advises folks to doc what occurred by utilizing screenshots if potential and writing down a timeline and what data was shared.

Individuals can view their credit score stories at AnnualCreditReport.com and arrange a fraud alert or credit score freeze with the most important credit score bureaus:

• Equifax – www.equifax.com

• Experian – www.experian.com

• TransUnie – www.transunion.com

McDonald inspired folks to share security suggestions with weak members of the family and assist them defend their accounts.

-

Michigan11 months ago

Michigan11 months agoUS District Judge rules that President Trump can dismantle USAID

-

Macomb County10 months ago

Macomb County10 months agoWho’s running for Michigan’s 10th Congressional District?

-

Michigan10 months ago

Michigan10 months agoWhen is Holland’s tulip festival? What to know about the west Michigan event

-

National News11 months ago

National News11 months agoWATCH LIVE: Stranded NASA astronauts heading back to Earth in SpaceX capsule

-

Michigan11 months ago

Michigan11 months agoPresident Trump’s Address to Congress – Key Takeaway

-

Michigan10 months ago

Michigan10 months ago5 common Michigan snakes you may see as the weather warms

-

Michigan10 months ago

Michigan10 months agoMichigan hunter? Here’s a list of the hunting seasons for 2025

-

Oakland County9 months ago

Oakland County9 months agoLa Loulou brings a slice of Paris to Piedmont Ave., Cafe Noir moves to Prescott Market